This Accounting degree is globally recognised, and it encompasses a rigorous curriculum that provides future accountants with contemporary knowledge and practical skills in assisting organisations to make the best strategic decisions. The effective combination of examinations, projects and assignments in this programme together with the placements with key industry partners enhance the students' learning experience.

Graduates will gain entry into the professional level of ACCA and CPA Australia. This course will also equip graduates to pursue further professional qualifications with CFA, CFP, CIMA, ICAEW, and MIA, among others.

| Approval Code | (R2/344/6/0074)(01/27)(MQA/FA1421) |

| Intake | Jan, May, Sep |

| Affiliation / Partner |  |

| Mode of Study | Full Time |

| Duration of Study | 3 Years |

| Assessments | Examinations, Projects, Assignments, Final Year Project |

| Tuition Fee | RM 45,555 (Malaysian students), RM 45,555 (International students) |

- MUET Band 2/ IELTS Band 5.5/ TOEFL 550 (STPM and UEC students)

- Pass STPM with 2 Grade C+ (GP 2.33) and a credit (C) in SPM Maths

- Pass UEC with minimum 5 Grade B including Maths and pass (C) in English

- Pass A-Level with 2 Grade D

- Pass Matriculation/ Foundation with CGPA 2.50/ 4,00 and a credit (C) in Maths at SPM level

- An accounting/ business related diploma with CGPA 2.50/ 4.00 (conducted fully in English)

| MQA Requirements | Malaysian students who obtained the following qualification are EXEMPTED from attending English classes | STPM/ UEC graduates are NOT EXEMPTED from attending MPI’s Intensive English and English Enhancement if:- | |

| Malaysian Students | At least:

|

|

|

| International Students |

|

- Microeconomics

- Introductory Accounting

- Statistics and Its Application

- Fundamental of Management

- Business Law

- Macroeconomics

- Introduction to Financial Reporting

- Co-Operative Placement 1

- Introduction to Management Accounting

- Business Communication

- Company Law

- Intermediate to Financial Reporting

- Accounting Information Systems

- Financial Management I

- Intermediate Management Accounting

- Data Analytics for Accounting

- Business Research Methods

- Malaysian Taxation

- Advanced Management Accounting

- Co-Operative Placement 2

- International Business

- Auditing and Assurance

- Financial Research Project A

- Advanced Financial Reporting

- Financial Management 2

- Malaysian Corporate Taxation

- Advance Financial Management

- Financial Research Project B

- Advance Auditing and Assurance

- Integrated Case-Study

- Co-Operative Placement 3

- Corporate Governance, Risk and Professional Ethics

- Organizational Behaviour

- Fundamentals of Marketing

- Entrepreneurship

- Managing People

- Strategic Management

- Penghayatan Etika dan Peradaban

- Falsafah dan Isu Semasa / Bahasa Melayu Komunikasi*

- Bahasa Kebangsaan A**

- University Life

- Extracurricular Learning Experience I, II, III

**Malaysian students who do not have a credit in their SPM Bahasa Melayu are required to take this as component of U2, only once.

Accounting is a specialised discipline that provides an ideal platform for a career in the field of Accountancy and Finance. Accountants and Auditors is ranked Top 10 as a recession proof jobs in the market. Accountants and auditors are expected to experience much faster than average employment growth in near future. Potential careers of graduates include the following sectors:

- Audit

- Financial Analysis

- Taxation

- Budget Analysis

- Management Accounting

- Banking

- Accountancy

- Strategic Business Consultancy

|

Chartered Tax Institute of Malaysia Exempted from 5 papers out of 8 papers |

|

|

Certified Practising Accountant Exempted from 6 papers out of 12 papers |

|

|

Chartered Institute of Management Accountants Exempted from 7 papers out of 16 papers |

|

|

Institute of Chartered Accountants in England and Wales (ICAEW) Exempted from 4 papers out of 15 papers |

|

|

The Chartered Institute for Securities & Investment (CISI) Complete 6 levels to become a Chartered Fellow |

|

|

The Chartered Institute of Public Finance & Accountancy Exempted from 6 papers out of 12 papers |

|

|

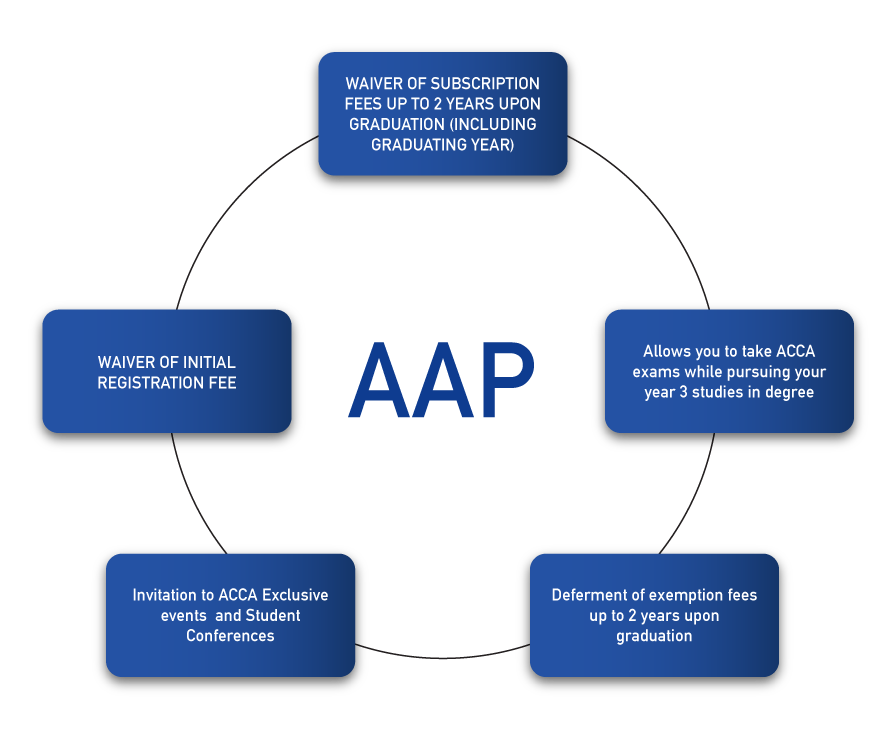

Association of Chartered Certified Accountants ACCA accelerate programme |

|

|

||